The Definitive Guide to Lighthouse Wealth Management, A Division Of Ia Private Wealth

Wiki Article

The 2-Minute Rule for Lighthouse Wealth Management, A Division Of Ia Private Wealth

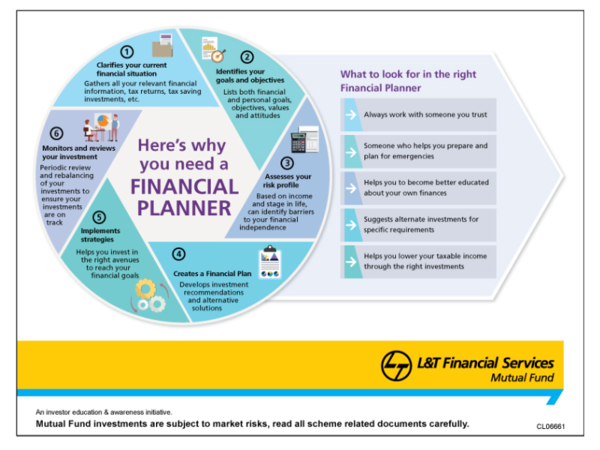

These are all points your economic expert can tackle. Many consultants satisfy with their customers to go over financial investment possibilities.

That might include discussions around estate planning, insurance coverage, social safety and security, and much more. All you need to do is ask as many questions as feasible throughout these conferences.

This safeguards your monetary future as it enhances the chances of finance authorizations. Lenders consider your past repayment history when deciding whether to approve your loans. As opposed to prominent belief, financial preparation is not a one-size-fits-all procedure. Saving is simply one item of the financial planning problem. Several aspects identify the most effective technique for different individuals.

Sometimes, conserving could be your ideal option, yet other times, your solution may be spending (ia wealth management). It's up to your economic consultant to aid you select the very best method relying on your requirements. So, hire a monetary consultant for a strategy that'll assist fulfill your monetary objectives. There are hundreds of investment chances.

The Buzz on Lighthouse Wealth Management, A Division Of Ia Private Wealth

Producing properly varied portfolios requires a considerable amount of time and competence. So, it 'd be best if you were to hire a financial expert to aid you instead of go at it by yourself. It's also much more meaningful for you to guarantee your economic consultant is a fiduciary - https://www.avitop.com/cs/members/lighthousewm.aspx. [Insert web link to the RIA difference web page] This will offer you assurance understanding that ideas and assistance are based solely on your ideal rate of interests and not on the what would be a lot more rewarding for your advisor.

Have you chosen to work with a financial expert? The next action is locating the best specialist. A financial consultant will certainly aid with monetary preparation, investment choices, and wide range management. A consultant who is a fiduciary will see to it all decisions are made in your benefit. It's never ever too early or also late for professional economic planning.

You will choose one of the fastest-growing occupation alternatives in India. As the nation expands at a fast lane and creates a large center course and HNI populace, there is an expanding need for Financial Advisors. This stays an extremely affordable occupation alternative where just the finest in profession increase up the pyramid.

A number of characteristics or elements separate the ideal Economic Advisors from the average or negative ones in the market. Not everybody who selects to be a Monetary Advisor is born with these high qualities, however you can easily imbibe these traits and create your name in this career.

Lighthouse Wealth Management, A Division Of Ia Private Wealth Things To Know Before You Get This

The first and one of the most vital top quality of a Monetary Advisor is an unrelenting interest for financing and the work. This isn't a normal task but one that would certainly check your analytical capacity every solitary day. Though you 'd be aided by tons of information and lots of tools, you will certainly need to utilize your expertise in financing and use that anchor in special ways to obtain preferred results for your customers. http://www.place123.net/place/lighthouse-wealth-management-a-division-of-ia-private-wealth-victoria-bc-canada.

You have to have a passion for financing and constantly remain ahead in the game. The legislations, laws, and conformity demands worrying financial investment, planning, and finance keep altering regularly and you should stay informed with them. For example, a small change in tax regulations can affect your clients' lifelong investment planning or enhance their tax obligation and you need to have a thorough understanding of just how these laws would certainly affect your clients and have the ability to recommend the right kind of change in approach to leverage these changes and not become a victim of it.

There ought to be no ambiguity in your judgment and your absence of understanding or outdated knowledge must not return to hurt your customers. In basic words, you should have fire in your belly and without it, you would certainly never ever be successful in this race - private wealth management canada. Investments, tax preparation, retirement planning is a vibrant field

The very best methods employed a couple of years back might not be the ideal for the present and the future. Hence, a Financial Consultant needs to have their hands on the pulse of the market and recommend the best financial investment and retirement alternatives to their clients (https://lighthousewm.carrd.co/). It requires an excellent Financial Consultant to be intellectually curious and you have to regularly lookout for the most current trends and methods on the market

Lighthouse Wealth Management, A Division Of Ia Private Wealth Things To Know Before You Get This

You must be a long-lasting learner and never ever rest over the laurels of the past. It is essential to be on a path of self-improvement and gaining from past errors. You will not call it ideal every time and with every customer but you have to always gather brand-new knowledge that allows you aid the majority of your customers meet their monetary objectives.

Every client is different features different sets of economic objectives, risk hunger, and has various horizons for investment. Not all customers are fantastic communicators and you need to place your curiosity to great usage and recognize their goals. Discovering the special needs of a client and suggesting the very best choices is just one of one of the most important qualities in this career.

Report this wiki page